Latvian investors show strong interest in forestry: key insights from the 2025 Investor Pulse report

1. Introduction

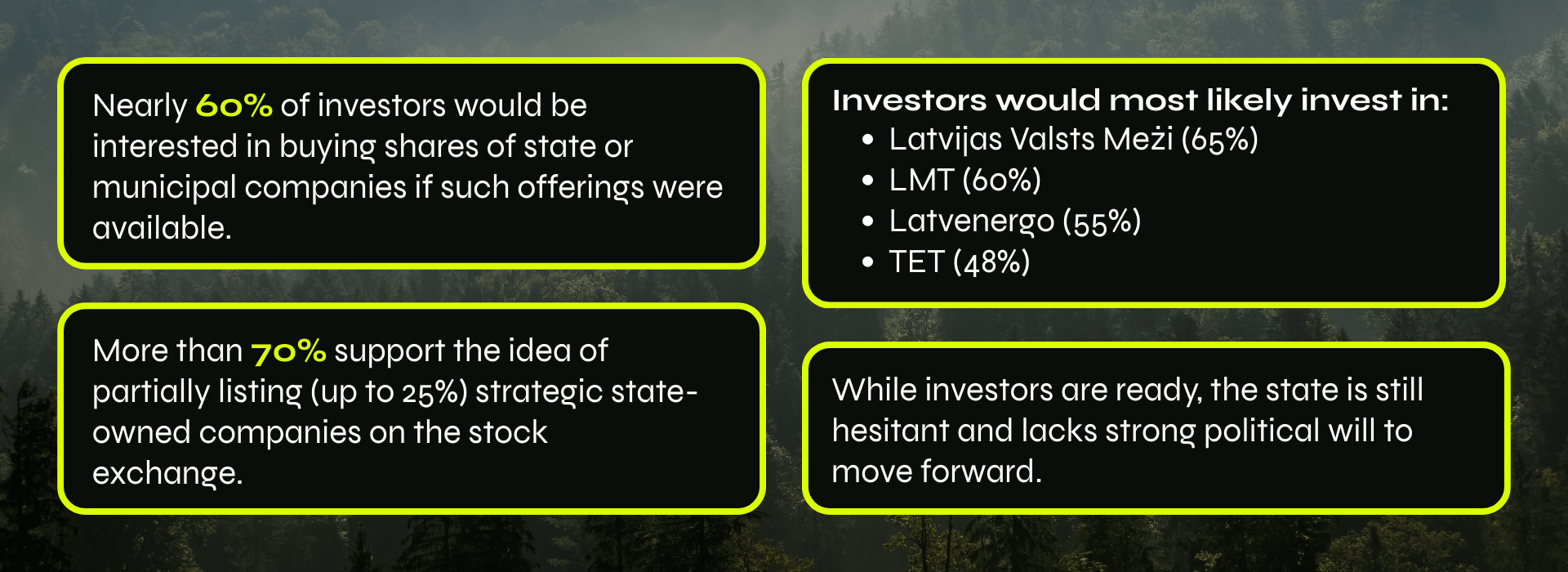

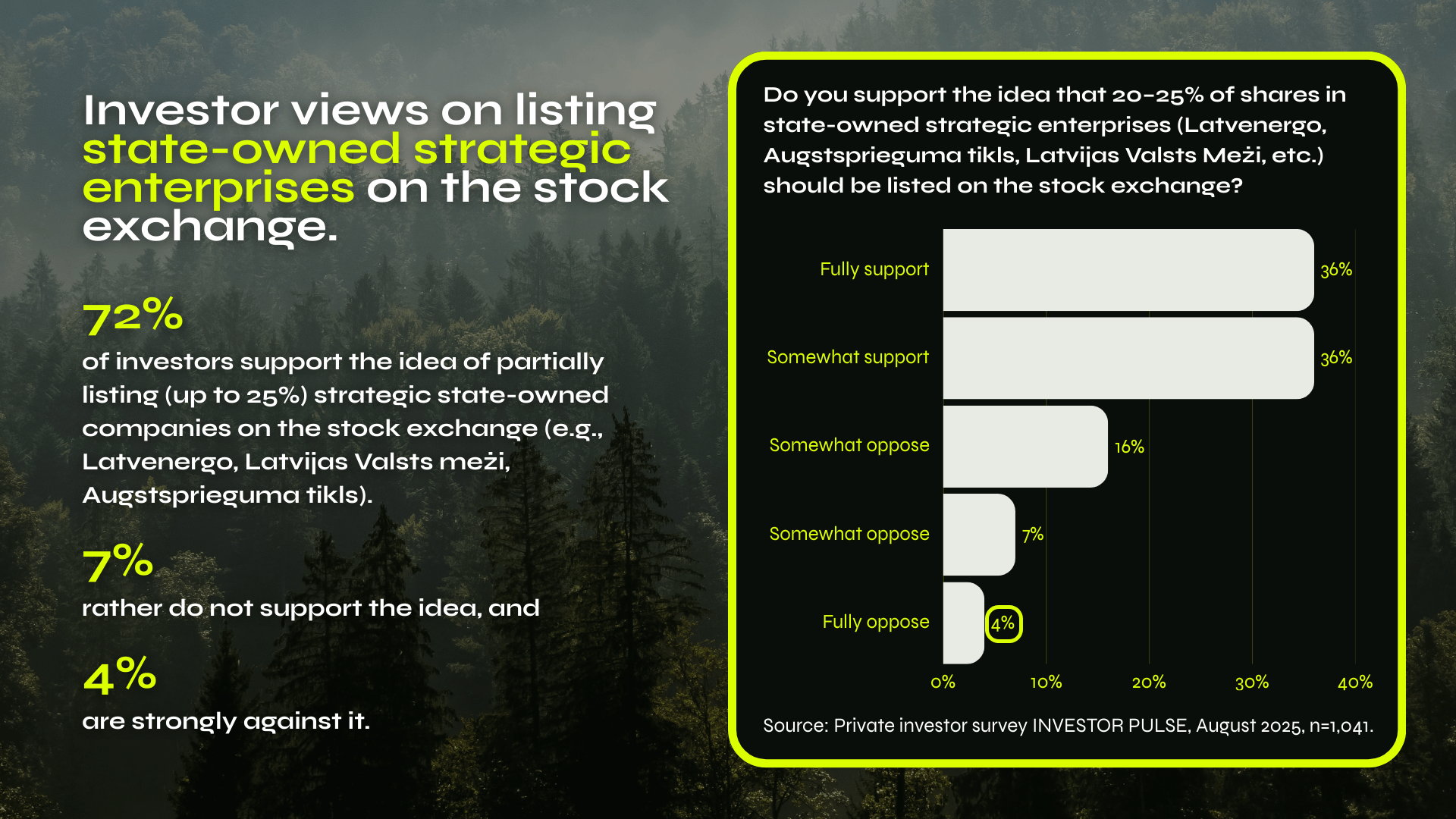

Latvia has long been viewed as one of Europe’s greenest countries, and recent data confirms that forestry-related assets remain central in the financial mindset of local investors. According to the Investor Pulse Latvian Report 2025

, 65% of respondents said they would consider allocating capital to Latvia’s State Forests (Latvijas valsts meži) - making forestry the most preferred segment among the surveyed state and private companies.

This strong interest highlights an important trend: while many Latvian investors are waiting for potential IPOs of state-owned enterprises, FF Forest already offers access to the forestry sector through a different, more accessible model - lending with fixed interest, full asset backing, and even a possibility of early exit if needed.

At FF Forest, individuals do not buy forest land and do not become shareholders. Instead, they lend funds to secured forestry projects that support restoration, maintenance, and sustainable land use - receiving fixed interest under a transparent lending structure.

2. Investor Sentiment in Latvia – Key Insights

Based on the April 2025 report:

65% selected Latvia’s State Forests as a preferred capital allocation target.

60% pointed to LMT.

55% identified Latvenergo.

48% chose TET.

Forestry leads the list — this suggests that local investors perceive forests, timber, and land assets as stable, long-term stores of value within the green economy.

The report also emphasizes a structural gap:

investors show strong interest in the sector, but accessible, transparent lending instruments remain limited. Most capital is waiting for clear, regulated vehicles that allow participation without buying land or waiting for IPOs.

This is where lending platforms such as FF Forest fill the gap: structured, secure, and tied to tangible assets.

3. Portrait of the Latvian Investor: What the Report Reveals

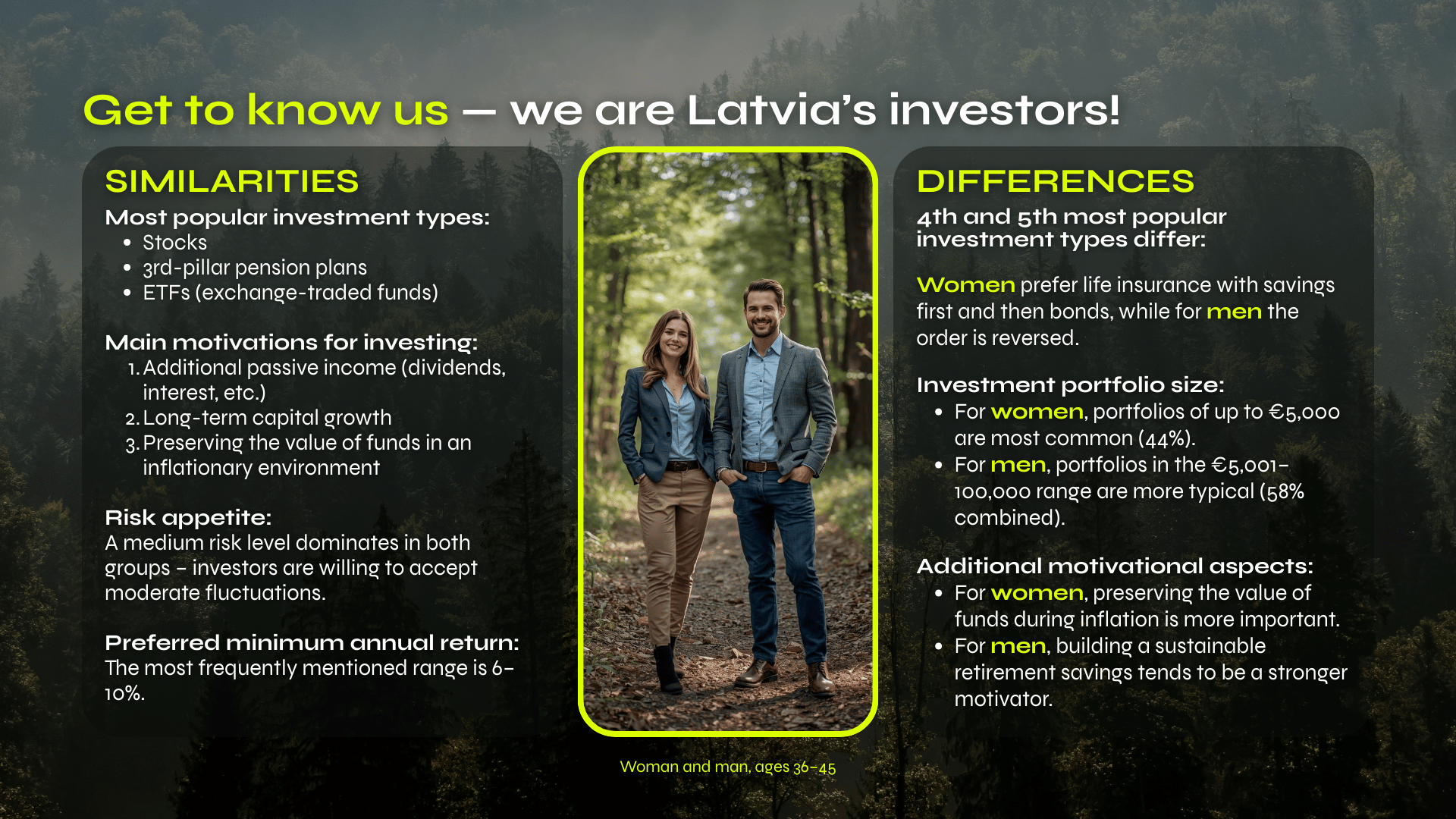

To understand why forestry ranks so highly, it is useful to look at the investor profile — the typical portrait of a Latvian investor — based on the 2025 survey:

Key characteristics:

Risk-averse, but seeks tangible value.

Forestry, land, and utilities appeal because they represent physical, regulated, long-term assets.Prefers transparency and security over speculation.

Investors want clear structures, understandable income models, and reliable oversight.Interested in sustainable, environmentally aligned projects.

ESG and green economy initiatives significantly influence sentiment.

Long-term thinking.

Many respondents consider assets that preserve value over decades, not months.

Why forestry fits this profile

Forests are perceived as:

stable in value even in volatile markets,

connected to national identity and long-term planning,

attractive from both a financial and ecological perspective.

The report shows that Latvian investors are not only financially conscious but also naturally oriented toward tangible assets with environmental relevance — which explains the strong alignment with forestry lending.

4. Why Forestry Lending Makes Sense in Latvia

Forestry lending through FF Forest offers multiple advantages that align with current investor sentiments.

Real natural assets

Forest land in Latvia is a tangible asset, with legal registration in national registers and subject to regulatory oversight.

Secured loan model

Unlike speculative investments, our model is structured as a loan: you lend funds, we deploy them into forest restoration, harvesting, and reforestation, and you receive interest and principal repayment under a transparent schedule.

Fixed interest, clear terms

For example, borrowers can expect interest rates up to 18% p.a. for a 24-month term, with minimum lending from €500. (Exact terms depend on project.)

Unique advantage: early exit flexibility

A key feature that differentiates FF Forest from classical fixed-term forestry instruments is the possibility of an early exit in case of life changes or liquidity needs — a rare option in natural-asset-based financing.

Environmental impact narrative

Your lending supports reforestation, CO₂ credit generation, and responsible land conversion — increasing biodiversity and supporting Europe’s circular economy.

These points mirror the data from the investor sentiment report: forestry is seen as an asset class of choice for many capital allocators in Latvia.

Conclusion

The Investor Pulse Latvian Report 2025 confirms one clear trend:

Latvia’s investors trust real assets — especially forests.

But while many await the potential IPOs of major state-owned enterprises, the market already provides accessible ways to participate in the forestry sector.

FF Forest offers exactly that:

a lending model with fixed interest, real collateral, full transparency, and the rare benefit of early exit.

It captures the strengths of Latvia’s most trusted asset class while offering a modern, regulated, and flexible approach tailored to today’s investor profile.